All Categories

Featured

Table of Contents

You'll fill out an application that contains general individual information such as your name, age, and so on as well as an extra comprehensive survey about your medical history.

The brief solution is no. A degree term life insurance plan doesn't develop cash money value. If you're seeking to have a plan that you have the ability to take out or obtain from, you might discover long-term life insurance policy. Whole life insurance policies, as an example, allow you have the convenience of fatality benefits and can accrue money value gradually, implying you'll have more control over your benefits while you're to life.

Cyclists are optional arrangements included to your policy that can give you additional advantages and securities. Motorcyclists are a fantastic method to include safeguards to your plan. Anything can take place throughout your life insurance policy term, and you intend to be ready for anything. By paying just a little bit extra a month, riders can provide the support you need in case of an emergency situation.

There are instances where these benefits are developed into your plan, yet they can also be offered as a different enhancement that calls for added payment.

Reputable What Is Direct Term Life Insurance

1Term life insurance policy supplies short-term security for a crucial period of time and is generally cheaper than permanent life insurance policy. 2Term conversion guidelines and limitations, such as timing, may apply; as an example, there might be a ten-year conversion opportunity for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Alternative in New York City. 4Not offered in every state. There is a price to exercise this rider. Products and cyclists are offered in authorized jurisdictions and names and functions may differ. 5Dividends are not assured. Not all participating plan proprietors are eligible for dividends. For pick cyclists, the problem applies to the guaranteed.

(EST).2. Online applications for the are readily available on the on the AMBA internet site; click on the "Apply Now" blue box on the right-hand man side of the web page. NYSUT participants can additionally publish out an application if they would certainly favor by clicking the on the AMBA web site; you will then need to click "Application" under "Forms" on the right hand side of the page.

Renowned Level Premium Term Life Insurance Policies

NYSUT participants registered in our Degree Term Life Insurance Strategy have access to supplied at no extra cost. The NYSUT Member Conveniences Trust-endorsed Degree Term Life Insurance policy Strategy is underwritten by Metropolitan Life insurance policy Business and provided by Association Participant Conveniences Advisors. NYSUT Trainee Members are not eligible to join this program.

Term life insurance coverage can last for a collection duration of time and normally has initial prices that raise at set intervals. Usually, it does not construct cash money value. Permanent life insurance coverage, additionally called whole life insurance coverage, can last your whole life and might have higher first rates that do not usually increase as you age.

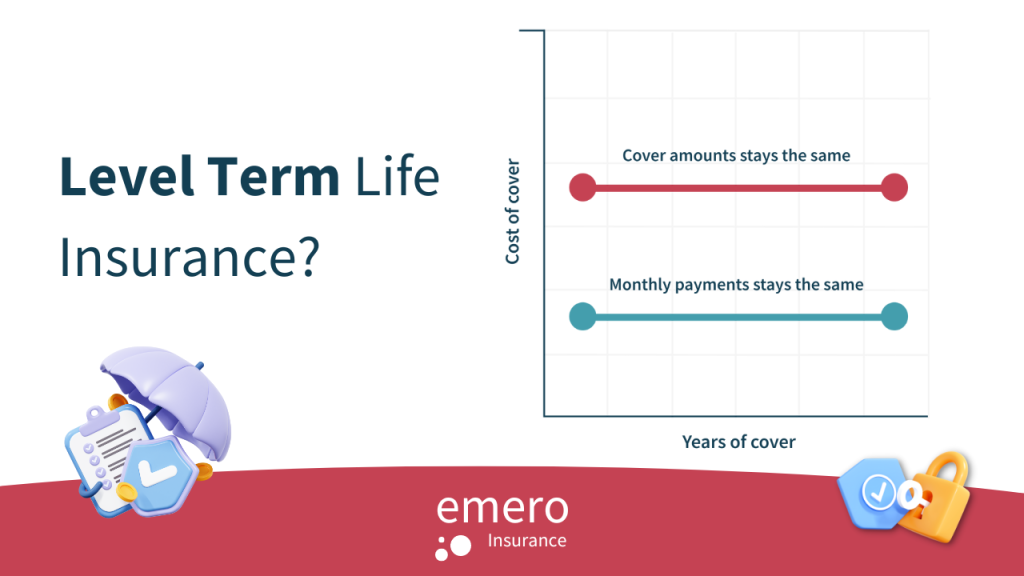

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year plans. One of the most popular kind is level term, meaning your settlement (premium) and payout (death benefit) stays level, or the same, up until the end of the term period. This is one of the most straightforward of life insurance policy choices and needs really little upkeep for policy proprietors.

You could offer 50% to your spouse and divided the remainder amongst your adult kids, a moms and dad, a good friend, or also a charity. * In some circumstances the death benefit may not be tax-free, discover when life insurance policy is taxable.

This is no matter whether the insured individual passes away on the day the plan starts or the day prior to the policy ends. Simply put, the quantity of cover is 'degree'. Legal & General Life Insurance Policy is an example of a degree term life insurance policy policy. A level term life insurance policy policy can fit a wide variety of circumstances and needs.

Your life insurance policy plan could also create component of your estate, so might be subject to Inheritance Tax found out more regarding life insurance policy and tax. level premium term life insurance policies. Allow's take a look at some functions of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life Insurance), or 67 (with Vital Disease Cover)

Reliable Direct Term Life Insurance Meaning

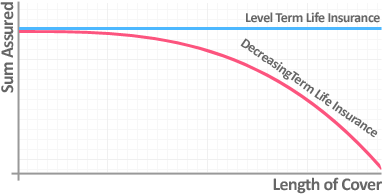

What life insurance policy could you consider if not level term? Decreasing Life Insurance Policy can assist secure a settlement mortgage. The quantity you pay remains the very same, yet the level of cover lowers about in line with the means a settlement mortgage reduces. Reducing life insurance policy can aid your enjoyed ones remain in the family members home and avoid any type of further disruption if you were to pass away.

Life insurance is a vital way to protect your liked ones. Degree term life insurance coverage is what's known as a degree costs term life insurance plan.

A degree term life insurance policy policy can give you comfort that individuals that depend on you will have a survivor benefit during the years that you are planning to sustain them. It's a way to aid look after them in the future, today. A level term life insurance (often called level premium term life insurance policy) plan offers coverage for an established number of years (e.g., 10 or 20 years) while keeping the costs settlements the very same for the duration of the policy.

With degree term insurance, the cost of the insurance policy will certainly remain the same (or possibly lower if dividends are paid) over the term of your policy, usually 10 or two decades. Unlike permanent life insurance coverage, which never ends as lengthy as you pay costs, a degree term life insurance policy plan will certainly end at some time in the future, normally at the end of the duration of your degree term.

Value Term Life Insurance With Accelerated Death Benefit

As a result of this, lots of people utilize irreversible insurance policy as a secure monetary planning tool that can serve many requirements. You might be able to convert some, or all, of your term insurance during a collection duration, generally the first one decade of your policy, without needing to re-qualify for protection also if your health has actually transformed.

As it does, you might desire to add to your insurance coverage in the future. As this takes place, you may want to at some point lower your fatality benefit or take into consideration converting your term insurance coverage to a permanent plan.

Latest Posts

Great Western Insurance Company Final Expense

Average Cost Of Final Expenses

Affordable Burial Insurance Policies